It is important that an individual file his/her tax return using the correct ITR form notified for that year.

The last date of filing an income tax return for FY 2020-21 i.e., December 31, 2021, is approaching soon. Which ITR form is applicable to you for FY 2020-21? Your employer will rectify the mistakes in Form-16 and issue you a revised form. If there is any discrepancy, then you must bring this to your employer's notice. While receiving Form-16, one must check that the PAN mentioned on it is yours.

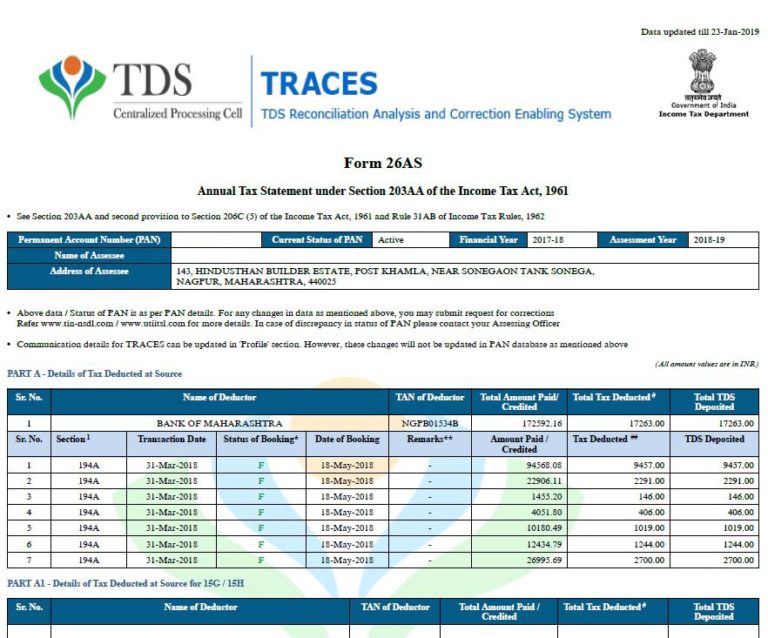

ITR filing documents you need for FY 2020-21 As per the notification, CII for FY 2021-22 shall come into effect from Apand will be applicable to assessment year 2022-23 and subsequent assessment years. at the time of income tax returns filing for FY 2021-22 or AY 2022-23. This CII number will be used to arrive at long-term capital gains such as from the sale of debt mutual funds, flat etc. The amended Form 26AS has become a potent tool in the hands of the tax authorities, which is why it is important for a taxpayer to know about information available in it.Ĭost inflation index for FY 2021-22 used for LTCG calculation notified by income tax department This tax passbook will be eventually replaced by the Annual Information Statement (AIS). Why Form 26AS is important while filing ITRįorm 26AS is a tax passbook containing details of taxes deducted and deposited during the financial year. Follow the steps below to download Form 26AS using either of the methods. Individuals can download Form 26AS from the new income tax portal or via an internet banking facility.

How to download Form 26AS: Here are two waysįorm 26AS is an important income tax document containing all the details of taxes deducted and deposited against the PAN during the financial year.

0 kommentar(er)

0 kommentar(er)